Artificial Intelligence (AI) is reshaping industries worldwide, and the finance sector is no exception. The integration of AI in finance has opened new avenues for innovation, efficiency, and enhanced decision-making. Financial institutions are leveraging AI technologies to automate processes, predict market trends, manage risks, and provide personalized customer experiences. This article explores how AI is transforming the financial landscape, the benefits and challenges of its implementation, and what the future holds for this technological revolution.

The Evolution of AI in Finance

How AI is Transforming the Financial Sector

The financial sector has been quick to adopt AI technologies to keep up with the increasing demand for fast, accurate, and data-driven services. From early implementations of algorithmic trading systems to today’s sophisticated AI models, the journey has been transformative. AI’s ability to process vast amounts of data in real-time and provide actionable insights has made it indispensable in the financial world.

Early Adoption of AI in Banking and Finance

The journey of AI in finance began with simple automation tools like Automated Teller Machines (ATMs) and evolved into complex systems capable of performing algorithmic trading. One of the earliest adopters of AI was the stock market, where high-frequency trading (HFT) became a game-changer, enabling rapid execution of trades based on market data and predictive analytics.

Key Milestones in AI Integration

Significant milestones include the development of AI-powered risk management tools and the deployment of chatbots for customer service. Financial giants like JPMorgan and Goldman Sachs have invested heavily in AI to optimize their operations, reduce costs, and improve customer engagement. The advent of machine learning has further enabled these institutions to refine their models continually, adapting to new data and evolving market conditions.

Current Trends in AI for Finance

Today, AI is used not just for trading and customer service but also for credit scoring, fraud detection, and regulatory compliance. For example, machine learning algorithms can analyze patterns in transaction data to identify potentially fraudulent activity. Moreover, AI is helping firms stay compliant with stringent regulations by automating the review of legal documents and transaction reports.

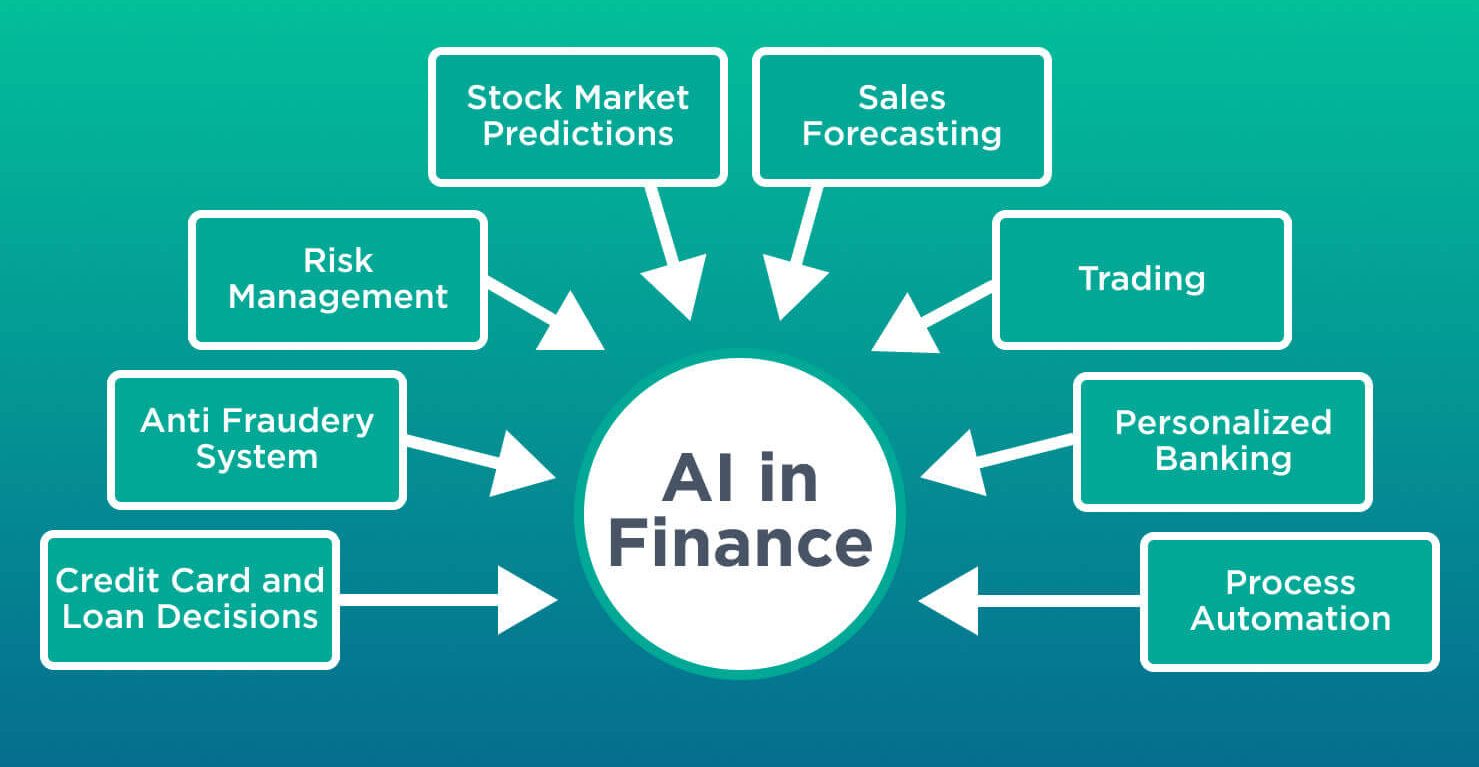

Key Applications of AI in Finance

Exploring the Main Applications of AI in Finance

AI’s applications in finance are as diverse as they are impactful. From enhancing customer service to revolutionizing investment strategies, AI is making significant inroads into various financial processes. Here are some of the most prominent applications:

AI in Fraud Detection and Prevention

Fraud is a significant concern in the financial industry, costing businesses billions annually. AI systems can detect unusual patterns in transaction data, flagging suspicious activities for further investigation. Companies like PayPal use AI to differentiate between legitimate and fraudulent transactions in real-time, reducing the risk of fraud and enhancing customer trust.

AI for Risk Management and Compliance

Risk management is another critical area where AI shines. Traditional risk management models often fail to account for complex market variables. AI, with its ability to analyze vast datasets and identify hidden correlations, provides a more robust framework for assessing risk. For instance, AI-driven models can predict the likelihood of a loan default based on a borrower’s financial behavior and market conditions.

Enhancing Customer Experience with AI Chatbots

Customer service in finance is undergoing a revolution with the advent of AI chatbots. These virtual assistants can handle a variety of customer queries, from account balance inquiries to investment advice, 24/7. They not only improve customer satisfaction by providing instant responses but also reduce operational costs. For example, Bank of America’s chatbot, Erica, offers customers personalized financial guidance based on their spending patterns and financial goals.

AI in Investment and Trading Algorithms

Investment firms are leveraging AI to optimize trading strategies and make informed investment decisions. AI-powered trading algorithms can analyze historical data and current market trends to identify profitable trades. Robo-advisors like Betterment and Wealthfront use AI to offer personalized investment advice, making sophisticated financial planning accessible to a broader audience.

Predictive Analytics and Financial Forecasting

AI is revolutionizing financial forecasting by providing more accurate predictions based on real-time data. Predictive analytics tools can forecast market trends, enabling businesses to make proactive decisions. This capability is particularly useful for portfolio management, where AI can predict asset price movements and optimize asset allocation.

Benefits and Challenges of Implementing AI in Finance

Benefits and Challenges of AI Adoption in Financial Services

While the benefits of AI in finance are numerous, its adoption is not without challenges. Understanding both sides is crucial for organizations considering AI implementation.

Benefits of AI for Financial Institutions

AI offers several advantages, including improved efficiency, reduced operational costs, and enhanced decision-making. For instance, AI-powered automation can handle routine tasks such as data entry and compliance checks, freeing up human resources for more strategic roles. Furthermore, AI’s ability to analyze vast datasets allows for more informed decision-making, reducing risks and improving profitability.

Common Challenges in Implementing AI Solutions

However, implementing AI in finance comes with challenges such as data privacy concerns, integration with existing systems, and the need for skilled personnel. Financial data is highly sensitive, and ensuring its security while using AI models is a significant concern. Additionally, integrating AI with legacy systems can be complex and costly. There is also a shortage of professionals skilled in AI and finance, which can hinder adoption.

Overcoming Barriers to AI Adoption in Finance

To overcome these challenges, organizations must invest in data security measures, train their workforce in AI technologies, and adopt a phased approach to AI implementation. Collaborating with AI specialists and technology partners can also help mitigate risks and ensure a smoother transition.

Case Studies: Successful Implementation of AI in Finance

Real-World Examples of AI Transforming Finance

Several financial institutions have successfully integrated AI into their operations, demonstrating its potential to transform the industry.

AI in Investment Banking: The Case of JPMorgan

JPMorgan has been at the forefront of AI adoption in investment banking. Their AI-powered tool, COiN (Contract Intelligence), automates the review of legal documents, significantly reducing the time required from thousands of hours to mere seconds. This has improved the efficiency and accuracy of contract reviews, freeing up legal teams to focus on more complex tasks.

How Mastercard is Using AI for Fraud Prevention

Mastercard employs AI to detect and prevent fraud in real-time. Their Decision Intelligence solution uses machine learning to analyze transaction data and assess the likelihood of fraudulent behavior. This has reduced false declines and enhanced the security of transactions, improving the overall customer experience.

AI in Personal Finance: The Case of Robo-Advisors

Robo-advisors like Betterment and Wealthfront have made personal finance management accessible and affordable. These platforms use AI to provide personalized investment advice based on individual financial goals and risk tolerance. By automating investment management, they offer a cost-effective alternative to traditional financial advisors.

The Future of AI in Finance

Future Trends and Predictions for AI in Finance

The future of AI in finance looks promising, with several emerging trends set to redefine the industry.

The Role of AI in Shaping FinTech Innovations

AI is at the heart of many FinTech innovations, from decentralized finance (DeFi) to blockchain-based smart contracts. These technologies are poised to disrupt traditional banking models, offering more efficient and transparent financial services.

Ethical and Regulatory Considerations

As AI continues to evolve, so do the ethical and regulatory challenges associated with its use. Issues such as data privacy, algorithmic bias, and the transparency of AI models are becoming increasingly important. Regulatory bodies are likely to implement stricter guidelines to ensure the ethical use of AI in finance.

The Potential Impact of AI on Financial Jobs

While AI can automate many tasks, it is unlikely to replace human workers entirely. Instead, it will change the nature of financial jobs, requiring professionals to develop new skills in data analysis, AI technology, and ethical considerations. Financial institutions will need to invest in retraining their workforce to stay competitive.

FAQs About AI in Finance

What is AI in Finance?

AI in finance refers to the use of artificial intelligence technologies to improve financial services. This includes applications such as automated trading, risk management, fraud detection, and customer service.

How is AI used in financial services?

AI is used in various ways, including automating routine tasks, analyzing data for risk assessment, providing personalized financial advice, and detecting fraudulent activities.

What are the benefits of using AI in finance?

AI offers several benefits, such as increased efficiency, reduced costs, improved decision-making, and enhanced customer experiences.

What are the challenges of implementing AI in financial institutions?

Challenges include data privacy concerns, integration with existing systems, and the need for skilled professionals in both AI and finance.

Will AI replace jobs in finance?

AI will transform, rather than replace, jobs in finance. It will automate routine tasks, allowing human workers to focus on more strategic roles that require complex decision-making and creativity.

Conclusion: Embracing AI for a Smarter Financial Future

The integration of AI in finance is not just a trend but a transformation that is here to stay. As AI technologies continue to evolve, they will offer new opportunities for financial institutions to innovate, improve efficiency, and provide better services to their customers. However, successful adoption requires a balanced approach that addresses the challenges and maximizes the benefits. By staying informed and adapting to these changes, the finance industry can harness the power of AI to create a smarter and more inclusive financial future.

Source:

https://cloud.google.com/discover/finance-ai

https://en.wikipedia.org/wiki/Applications_of_artificial_intelligence