In today’s fast-paced financial markets, investors need more than just raw data—they need insights, predictive analytics, and actionable signals. That’s where AI-powered investing platforms like Kavout come into play. As someone who has spent considerable time using Kavout for both personal investment research and professional portfolio optimization, I want to share an honest, detailed review of what this platform offers, how it stands out, and whether it might be right for you.

Whether you’re an individual investor, a fintech entrepreneur, or a financial professional looking to enhance your workflow with cutting-edge analytics, this review is for you.

Website: https://www.kavout.com

Overview of Kavout

Kavout is a cloud-based AI investing platform that leverages machine learning, big data, and quantitative models to help users discover, analyze, and act on stock market opportunities. Founded by a team of former Wall Street quants and AI engineers, Kavout has earned a reputation for innovation in the fintech industry, especially for its proprietary “Kai Score”—an AI-powered stock rating.

The platform primarily targets:

- Retail investors seeking smarter stock picks

- Professional asset managers and hedge funds

- Fintech firms wanting to integrate advanced analytics via API

Kavout’s core value lies in transforming overwhelming amounts of financial data into clear, actionable intelligence that helps users make faster, more informed investment decisions.

Key Features of Kavout

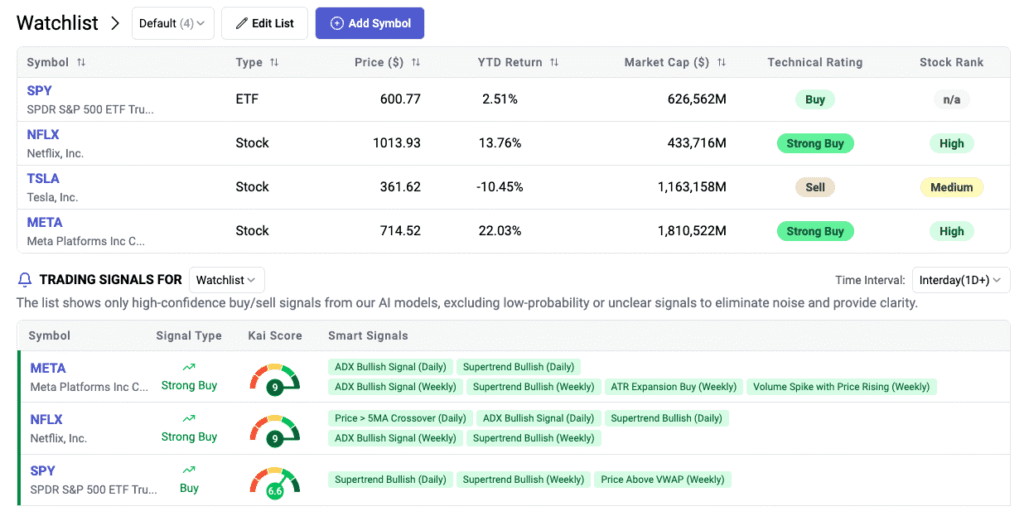

Kai Score™ (AI Stock Rating)

Kai Score is the signature innovation that sets Kavout apart from other investing tools. Developed as a proprietary AI rating system, the Kai Score processes millions of data points daily—including price action, fundamentals, analyst upgrades/downgrades, insider transactions, and even sentiment from news and social media. This isn’t just another “ranking”—it’s a dynamic, real-time measure of a stock’s overall health and upside potential, distilled down to a simple score from 0 to 10.

As an investor, I find Kai Score indispensable for its simplicity and depth. Instead of getting lost in dozens of ratios and indicators, I can start my research by looking for stocks with the highest Kai Scores. It’s especially powerful for idea generation: many of my most successful picks were first flagged by their surging Kai Score before the rest of the market caught on.

What makes Kai Score even more valuable is its adaptability. The score adjusts quickly as new data flows in—if a company posts a blowout earnings report, sees a wave of positive news coverage, or experiences unusual insider buying, its Kai Score can jump within a day. Conversely, a sudden drop in sentiment or a negative catalyst will be reflected just as fast. This real-time feedback loop gives investors an edge, helping you react proactively rather than retrospectively.

Benefits of using Kai Score:

- Gain early signals on momentum, sentiment shifts, or fundamental improvements before they appear in traditional research.

- Quickly surface high-potential stocks from a vast universe.

- Save time by filtering out low-scoring (high-risk or deteriorating) stocks.

AI-Powered Stock Screener

Kavout’s AI-powered screener takes traditional filtering to a new level. Instead of relying solely on static ratios or outdated screens, the tool allows you to combine Kai Score with a range of other criteria—including valuation metrics, profitability, growth rates, volatility, technical momentum, and sentiment data.

The screening process is straightforward yet remarkably flexible. For instance, I often set up screens to find stocks with a Kai Score above 8, accelerating revenue growth, and recent positive sentiment. It’s also possible to create screens for “turnaround” stories: companies with low recent price performance but rapidly improving news flow or analyst upgrades.

Another practical advantage is the ability to save and reuse your custom screens. This is ideal if you have a particular strategy—like momentum, value, or contrarian investing—and want to automate the search for new opportunities each week.

Key reasons to use the Stock Screener:

- Automate and streamline the research workflow, making idea discovery efficient and systematic.

- Identify stocks matching multiple layers of criteria (AI, fundamentals, technicals, sentiment).

- Find both high-flyers and hidden gems before they become obvious to the broader market.

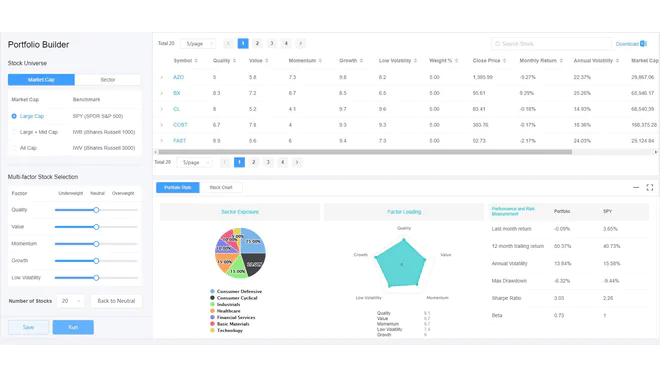

Portfolio Model/Builder

Portfolio management on Kavout goes well beyond basic tracking. The Portfolio Model/Builder helps you design, optimize, and monitor your investments with AI-driven insights. You can input your own rules (sector limits, risk tolerance, etc.) and get recommendations for asset allocation and rebalancing.

One feature I appreciate is the backtesting function. Before making any major allocation changes, I run my strategy through multiple historical scenarios. This data-driven approach has saved me from emotional mistakes and helped maximize risk-adjusted returns.

As markets shift, the builder provides ongoing recommendations, prompting you to rebalance or tweak allocations when there’s a significant change in Kai Score or macro signals.

Portfolio Builder highlights:

- Get AI-guided rebalancing alerts so your portfolio adapts with the market.

- Build and simulate portfolios for various goals and risk levels.

- Backtest strategies to learn from history before you commit real money.

Alternative Data & News Analytics

Kavout integrates real-time news and alternative data analytics into every layer of its platform. It doesn’t just pull in headlines; it analyzes the tone, volume, and context of news and social media chatter to generate a sentiment score for each stock.

I’ve avoided costly mistakes by monitoring these sentiment signals. For example, if a stock I hold starts attracting unusually negative press or a sudden surge of bearish analyst comments, I get alerted—sometimes before the price reacts. On the other hand, stocks with a quiet but building stream of positive news have often outperformed once the broader market catches up.

The value of News & Alternative Data Analytics:

- Integrate powerful “hedge fund-grade” signals into your daily decision-making.

- Spot inflection points missed by traditional financials or charts alone.

- React quickly to news-driven volatility and sentiment shifts.

API Data Service

For more technical users, quant teams, and fintech developers, Kavout’s API offering is a major asset. It provides direct access to live Kai Scores, financials, technicals, sentiment analytics, and more—allowing you to build custom dashboards, screeners, or even algorithmic trading systems on top of Kavout’s data engine.

I’ve personally used the API to feed daily Kai Score updates into Google Sheets and to trigger automated alerts when certain thresholds are met. The integration is robust and well-documented, making it suitable for everything from side projects to enterprise-scale solutions.

Typical use cases for the API:

- Enhance trading algorithms with proprietary AI signals.

- Power your own investment apps, dashboards, or quant models.

- Set up custom alert systems or portfolio monitoring tools.

Advanced/Developer Tools (API, Factor Analytics, Quant Research)

For power users and fintech teams, Kavout offers a suite of advanced tools. The API gives you direct access to all of Kavout’s AI-driven data streams, including Kai Scores, financials, and sentiment metrics, so you can build custom dashboards, trading systems, or research projects. I’ve used the API to automate watchlist management and build my own alert systems—saving hours every month.

Factor Analytics allow you to break down your portfolio or any stock list by classic investment factors such as Value, Growth, Momentum, and Quality, revealing hidden exposures and opportunities.

The Quantitative Research platform is a robust environment for backtesting, building systematic strategies, and validating new ideas—features that are especially valuable for professionals and serious DIY quants.

Why these tools matter:

- Test, refine, and automate strategies without leaving the Kavout ecosystem.

- Unlock full customization for research, trading, or product development.

- Power your own apps, dashboards, and quant models with institutional-grade data.

User Experience & Interface

Kavout excels in user experience. The interface is sleek, modern, and intuitive—even for newcomers. Navigation is straightforward, with a left-hand menu for main features and responsive dashboards for key data. Custom watchlists, screener results, portfolio dashboards, and news feeds are all easy to access and customize. The learning curve is gentle: even if you’re new to AI-driven investing, you’ll be up and running in minutes.

In terms of reliability, I’ve experienced almost no downtime, and the platform loads quickly—even when processing large amounts of data.

Pros & Cons

Pros

- Powerful AI analytics that go beyond traditional metrics

- Comprehensive data integration (fundamental, technical, sentiment, alternative data)

- Feature-rich platform: suitable for beginners, professionals, and quants

- Excellent user interface and ease of use

- Robust API for developers and fintechs

- Customizable signals and alerts keep you informed in real-time

Cons

- Some advanced features require a paid plan

- Coverage is primarily US/EU stocks (international markets are more limited)

- Platform is English-only (as of now, no multilingual support)

- For complete beginners, the depth of features might seem overwhelming at first

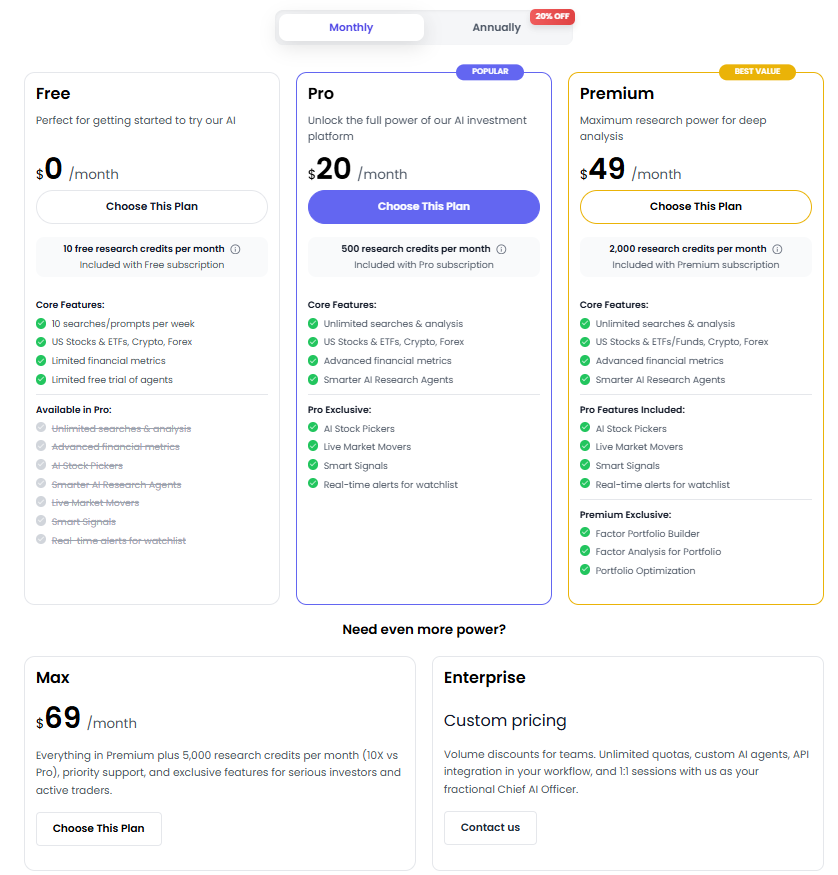

Kavout Pricing

Kavout’s pricing is very reasonable and flexible for different user needs. The Free plan lets beginners experience most core features without risk, while the Pro and Premium plans are competitively priced compared to other AI investing tools. For just $20/month, the Pro plan delivers robust AI-powered screening, smart signals, and unlimited analysis—great value for active investors. Premium and Max offer more credits and advanced tools, but are really only necessary for power users, professional traders, or portfolio managers.

Overall, Kavout provides excellent value at each tier. Most users will find the Pro plan sufficient, and it’s easy to upgrade as your needs expand. The pricing is transparent, with no hidden costs, making Kavout accessible whether you’re just getting started or managing a serious portfolio.

Pricing : https://www.kavout.com/pricing-plansUser Testimonials & Real-World Feedback

Browsing forums like Reddit, G2, and Trustpilot, the feedback on Kavout is largely positive:

- Users praise the Kai Score’s predictive accuracy and its ability to highlight hidden gems.

- The platform is described as “easy to use but surprisingly powerful.”

- Some users note a learning curve for advanced features, but most agree it’s manageable.

- Negative reviews mostly relate to market coverage limitations or requests for more global stocks.

Personally, I’ve seen my own screening process become faster and my portfolio decisions more data-driven since incorporating Kavout into my workflow.

Quick Start Guide

Getting started with Kavout is straightforward:

- Sign up with your email (free plan available).

- Explore the dashboard: Check out Kai Scores, trending stocks, and sample screeners.

- Build a watchlist of stocks you’re interested in.

- Use the screener to filter stocks by your preferred criteria.

- Create a portfolio and try out backtesting and AI-driven suggestions.

- Set up alerts for news, signals, or price movements.

- Upgrade to Pro if you need advanced analytics, unlimited alerts, or API access.

My tip: Start with the Free plan, play around with the core features, and only upgrade when you’re ready to dive deeper.

Conclusion & Final Thoughts

Kavout stands out as a next-generation AI stock analytics platform that empowers investors of all levels to make better, faster decisions. Its combination of proprietary AI (Kai Score), comprehensive screening, real-time alerts, and quant tools puts it ahead of many traditional platforms. While there are some limitations in terms of coverage and language, the overall experience is impressive.

Final verdict:

- If you’re looking for a data-driven edge in the markets, Kavout is absolutely worth trying—especially for growth investors, quants, and anyone who wants to harness the power of AI.

- The free trial makes it risk-free to test, and the platform’s innovation keeps it ahead of the curve in fintech.